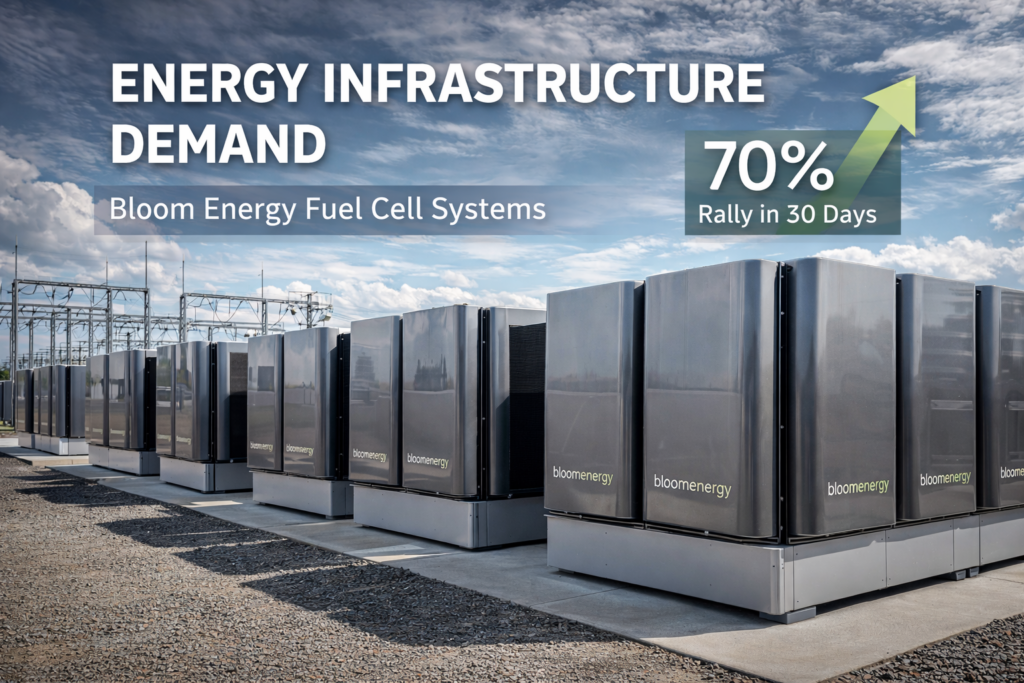

On January 26, 2026, U.S. markets continue to navigate a volatile backdrop marked by geopolitical headlines and earnings season implications, but one segment that has attracted notable investor attention is the clean energy infrastructure space. Among names gaining traction, Bloom Energy stands out as a stock that has been outperforming many traditional technology and AI-related names, driven by its solid oxide fuel cell solutions that address energy needs for data centers and enterprise-grade power applications.

reference site : Start-up investment http://changuptuja.com

As of market close on January 23, 2026, Bloom Energy’s share price was trading around $34.20 (price subject to market conditions at the time of writing). Over the past month, the stock has delivered impressive performance, with a gain exceeding +70% year-to-date, substantially outpacing many peers in both energy and tech segments. This performance reflects a confluence of factors including strong demand from data center operators seeking reliable and scalable energy solutions and strategic partnerships that lock in future capacity growth.

Recent price action shows that Bloom Energy has shifted from being perceived as a niche clean energy name to one meeting investor expectations tied to AI infrastructure buildouts, particularly as power reliability becomes a critical consideration for hyperscale computing facilities. This trend has been echoed in market commentary and community discussions where increasingly, investors highlight energy resilience as an underappreciated catalyst for broader market participation beyond traditional hardware or software plays.

That said, investors should remain mindful of the typical risks associated with high-momentum stocks, especially ones propelled by structural thematic narratives. Rapid appreciation often leads to stretched valuations, and while Bloom Energy’s fundamentals appear supported by expanding revenue streams and capacity deals, near-term volatility remains a realistic possibility. The broader market context, including macroeconomic uncertainty and geopolitical tariff headlines influencing risk appetite, could also contribute to episodic pullbacks in high-beta names.

For investors considering positioning in Bloom Energy around the current levels, the following reference price zones can serve as a framework based on technical levels observed over recent sessions:

- Reference Buy Zone: $30.00 – $32.50 – This range represents a more conservative entry point should the stock retrace after recent strength. Buying in this window allows for participation while cushioning against short-term pullbacks often seen following extended rallies.

- Near-Term Target Zone: $38.00 – $42.00 – Should demand for energy infrastructure solutions continue to accelerate and earnings confirmations align with narratives, this target range reflects a realistic upside in the near term, capturing profit-taking opportunities.

- Risk Management Stop-Loss Level: $27.00 – If the stock breaks below this level on a sustained basis, it would signal a potential loss of momentum, and investors may consider tightening risk exposures.

These price reference points are based on recent trend analysis and volatility patterns seen in Bloom Energy’s trading behavior. They are not personalized financial advice but rather strategic guideposts to assist in active investment decision making given the current market context.

The wider market environment shows mixed signals. Major indices have experienced intermittent volatility as investors balance earnings expectations from large technology firms with geopolitical developments that influence risk sentiment. In the near term, economic indicators and policy decisions, particularly around interest rate expectations and corporate earnings updates, could introduce additional directional cues for cyclicals and growth stocks alike.

This article is provided for informational purposes only and does not constitute investment advice. Price zones mentioned reflect conditions at the time of writing, and the ultimate investment decision and responsibility rests solely with the individual investor. Market conditions can change rapidly, and past performance is not indicative of future results.

Recommended keywords / hashtags

#BloomEnergy #EnergyInfrastructure #StockAnalysis #AIInfrastructureDemand #CleanEnergyStocks

reference site : Start-up investment http://changuptuja.com

0개의 댓글